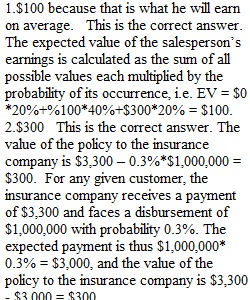

Q Question 1 1 / 1 pts On any given day, a salesman can earn $0 with a 20% probability, $100 with a 40% probability, or $300 with a 20% probability. His expected earnings equal Question 2 1 / 1 pts People in a certain group have a 0.3% chance of dying this year. If a person in this group buys a life insurance policy for $3,300 that pays $1,000,000 to her family if she dies this year and $0 otherwise, what is the expected value of a policy to the insurance company? Question 3 1 / 1 pts If Martha is willing to pay up to $350 for insurance against a loss of $7000 which will occur with a 4% probability, she is, Question 4 1 / 1 pts Upon purchasing a new refrigerator, you are deciding whether to also purchase the two-year warranty. The consumer guides that you have read say that ten percent of new refrigerators need repairs in their second year, and the cost of repair averages $500. The rest of the refrigerators need no repair. Assume a zero discount rate. Which of the following statements is true?

View Related Questions